| THEMES |

|

^MENU^

|

_LAWMAKERS MADE PROMISES IN 1994, ...BUT WHAT HAVE WE TO SHOW FOR IT?Americans of all political stripes demand change—time to revive from the ashes like the legendary Phoenix:CONTRACT WITH AMERICA: Part II®“CONTRACT WITH AMERICA: PART II”® is a registered trademark of Gordon Wayne Watts, application number 90607682 ; USPTO.gov Reg. No. 6,950,909 ; Registered Jan. 10, 2023, Int'l. Cl.: 042 ; Service Mark Principal Register ; SER. NO. 90-607,682, FILED 03-27-2021 ; FIRST USE 5-3-1998; IN COMMERCE 4-11-2022 ; US Serial, Registration, or Reference No. 90607682 -- AND: dedicated to creating an online presence and social media community for American voters for the purpose of seeking legislation to fix present, obvious, and egregious problems we face today. Our secondary goals are to educate the public, and seek redress in the other parallel venues (seeking representation in the Executive Branch, calling on The President, and other State, Federal, and local leaders -- and the news media -- and fellow-citizen), to assist us in our goals -- raising awareness, getting educated -- and, most-importantly, seeking practical, constructive solutions -- and not merely "complaining to one another" without actually doing anything to identify, address, and root out these endemic problems. We are not affiliated with the original "CONTRACT WITH AMERICA," whose expired USPTO Trademark application serial number is 74578820, by applicant, Republican National Committee. However, while we are attempting to "finish the job" done by the original CWA, and may agree on certain popular issues, of great public interest and importance, we are nonpartisan in nature, and fully expect a wide range of American voters on both ends of the political spectrum to support our platform, as we (like the original CWA movement) are restricting our "issues" SOLELY to those with "widespread" bipartisan support. IMPORTANT: Just as Newt Gingrich did with the "original" CWA, we, also, limit our issues strictly to "60% issues," that is, issues that garner support of at least 60% of Americans. By doing this, we can assure ourselves of a successful support of ALL Americans, on both sides of the political spectrum, Conservative, Liberal, Libertarian, and "moderate." While "non-profit" and "educational" in nature, we are not a 501(c)(3) registered organization, and any donations are not tax deductible, but welcomed.

I. Protecting and Upgrading our fragile Power and Telecommunications

Grid

II. Protecting our economy by careful remembrance of historical collapses of countries that

had excessive taxation, spending, and excessive printing of currency

III. Protecting our personal freedoms, as enshrined in the U.S. Constitution Americans of all political stripes demand change—time to revive the Contract --from the

ashes --like the legendary Phoenix: Begin "PART: II"

XI. Spending Tracker Websites (includes popular U.S. National Debt Clocks) Click *_here_* to jump back to the top of the page.

Recent solar superstorms shut down power grids, halted stock market trading, and disrupted Internet, communications (including your 911 service),

and satellites:

These unpredictable solar super storms, EMP (electromagnetic pulse) attacks, and cyber-hacking are not unlike the random hurricanes, tornadoes, droughts,

wildfires, floods, and hard freezes. The term "infrastructure" encompasses not just "roads and bridges" but also our power and telecommunications grid,

all of which need protection from these random -- but certain -- threats.

The infamous solar storm of March 1989 inflicted major damage to Quebec, Canada's power grid, causing a 9-hour blackout when transformers were overloaded

and failed, leaving more than 6 million Canadians without power, and crashing computer hard-drives later that year (August 1989), resulting in halted

trading in the Toronto stock market. In fact, astronauts aboard the space shuttle Atlantis, during this solar storm, in October 1989 reported burning in

their eyes as highly-charged solar particles hit them. The cause of this massive power / tel-com outage was only Solar Flares. Period.

Nothing else.

Another solar storm hit Canada, as well as the northeast United States, in August 2003, causing wide-spread blackouts, this time

jamming the short-wave radio frequencies used by commercial pilots, prompting contemporary observers to speculate that the Kremlin was jamming radio

signals. “In space, some satellites actually tumbled out of control for several hours,” NASA said.

More recently, the “Solar Storm of 2012,” documented to have have been even larger than the largest previous solar storm in recorded history, almost

made a “direct hit” on earth, narrowly missing only because earth had moved about nine (9) days [about 2.46% of earth's 365¼-day orbit] in solar orbit

from its trajectory. As earth's 'magnetic north pole' accelerates its erratic movement, earth's protective magnetic field has begun to speed up its

collapse, which would leave us completely vulnerable to another solar flare event. Register editor, Gordon W. Watts, who

was valedictorian of his college electronics class, has now submitted

this research paper with proposed solutions for citizens to prepare

and for Federal lawmakers to "harden the grid" to protect our critical communications and power grids, now much more sensitive than mere telegraphs,

which were damaged during the infamous "Carrington Event." Apparently, lawmakers didn't heed Watts' warning and take precautions: Just this past

Feb. 9, 2022, a solar storm knocked out & disabled at least forty (40) newly-launched SpaceX satellites, which powered its "Starlink" internet network,

according to

REUTERS. (LINKS: 1 ; 2 ; 3 ; 4 ;

5 ;

6 ;

7)

QUICK SURVEY -- "yes" or "no" question: Are you, the reader, "OK" with your 911 cell service, power, and Internet "going down" randomly -- as happened

in QUEBEC, CANADA, just recently -- due to lawmakers' stubborn refusal to "get up off a few more pennies" and harden/upgrade the grid? -- ANSWER: YES

or NO, please.

FAST FACT: The R.M.S. TITANIC had a crew manifest of 2,208 passengers the day it went down -- and a "maximum capacity" for 3,547 passengers, but

had only twenty (20) lifeboats, which, in sum-total, could only accommodate 1,178 persons. WHY?

Due to stubborn refusal of its owners/operators, the the White Star Line (WSL) shipping company, to "get up off a few more pennies" and purchase the

needed quantity and quality of lifeboats. LIVES WERE LOST BECAUSE OF THESE OVER-PAID, DISHONEST "PENNY PINCHERS." So, likewise, our current crop

of over-paid, under-performing Federal Lawmakers (U.S. Senators and Members of Congress) who do not care about aging roads and bridges, or our fragile &

vulnerable power, cell-tower, and Internet Grid and Infrastructure.

SOURCES:

“Solar

storm knocks out 40 newly launched SpaceX satellites,” by Steve Gorman (3 minute read), REUTERS, February 9, 2022,

5:42 PM (EST),

LINK ;

Archive Today cache ;

Wayback Machine archive ; Local

archive ; Mirror-1 cache ;

Mirror-2 cache ;

Mirror-3 cache

“A massive solar storm could wipe out almost all of our modern technology — and we'd have just hours to prepare,” by Rafi Letzter, BUSINESS INSIDER, 06 September 2016: Archive Today cache ; Wayback Machine archive “Storms from the Sun: The Emerging Science of Space Weather,” by Michael J. Carlowicz, Ramon E. Lopez, Publisher: Joseph Henry Press, 2002 - Science - 234 pages (as listed in Google Books), or 256 pages (as listed in Amazon), ISBN-10: 0309076420; ISBN-13: 978-0309076425: Amazon Product Listing ; Archive Today cache ; Wayback Machine archive “7 times solar storms have affected Earth,” by Matt Liddy, ABC NEWS, 01 April 2015; Small 'Fair Use' Quote: “Communications networks around the globe were affected, prompting speculation the Kremlin was jamming radio signals, while short-wave radio frequencies used by commercial pilots also suffered fadeouts.” ; Archive Today cache ; Wayback Machine archive “Service Assessment: Intense Space Weather Storms October 19 – November 07, 2003,” by Christopher Balch Team Leader (Lead Space Weather Forecaster, NOAA; Space Environment Center (SEC), Boulder, Colorado), Bill Murtagh (Lead Author, Space Weather Forecaster, NOAA Space; Environment Center, Boulder, Colorado), et. al., NOAA (National Oceanic and Atmospheric Administration, Silver Spring, MD), Technical Memorandum, U.S. Department of Commerce, April 2004: Archive Today cache ; Wayback Machine archive ; PDF file via Weather.gov ; Wayback Machine archive “HALLOWEEN SPACE WEATHER STORMS OF 2003,” by LCDR Michael Weaver (NOAA editor) William Murtagh (editor), Christopher Balch, et. al., NOAA (National Oceanic and Atmospheric Administration, Space Environment Center, Boulder, Colorado), NOAA Technical Memorandum OAR SEC-88, June 2004: Wayback Machine archive ; Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “The Day the Sun Brought Darkness,” by Dr. Sten Odenwald, NASA Astronomer, NASA, March 13, 2009, Last Updated: Aug. 7, 2017 (Editor: Holly Zell), Small 'Fair Use' Quote: “On March 13, 1989 the entire province of Quebec, Canada suffered an electrical power blackout. Hundreds of blackouts occur in some part of North America every year. The Quebec Blackout was different, because this one was caused by a solar storm! [] On Friday March 10, 1989 astronomers witnessed a powerful explosion on the sun. Within minutes, tangled magnetic forces on the sun had released a billion-ton cloud of gas. It was like the energy of thousands of nuclear bombs exploding at the same time. The storm cloud rushed out from the sun, straight towards Earth, at a million miles an hour. The solar flare that accompanied the outburst immediately caused short-wave radio interference, including the jamming of radio signals from Radio Free Europe into Russia. It was thought that the signals had been jammed by the Kremlin, but it was only the sun acting up!” ; Archive Today cache ; Wayback Machine archive (Mar. 2021) ; Wayback Machine archive (Oct. 2017) ; Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “Powerful solar storm narrowly missed Earth in 2012,” by Scott Sutherland, Meteorologist/Science Writer, The Weather Network, 02 May 2014; Small “Fair Use” Quote: “The current 'K-index' used to rate solar flares wasn't in use then, but studies have estimated the strength of the Carrington super flare at somewhere around X40 or higher, which is well off the maximum practical end of the scale (which only goes up to X9.9). [] However, as it turns out, it doesn't take one of these scale-shattering solar flares to produce this kind of powerful CME, and this means that we could be at a higher risk from solar flares than we previously thought...Given that this CME missed us by roughly 9 days, the use of the word 'narrowly' when describing how close it came to us may seem a bit excessive. However, when you look at those 9 days compared to the length of our year (the time it takes Earth to travel once around the Sun), the distance between us and the CME was only about 3 per cent of our orbital path. That's a pretty narrow miss.” EDITORIAL COMMENT: Actually, 9 days divided by 365¼ days is NOT even "3 per cent," but rather only 2.46%, rounded to 3 significant figures. ~Editor, Gordon Wayne Watts ; Archive Today cache ; Wayback Machine archive ; Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “SEVERE SPACE WEATHER--SOCIAL AND ECONOMIC IMPACTS,” by Author: Dr. Tony Phillips | Credit: Science@NASA ; NASA Official: Dr. Mamta Patel Nagaraja ; January 21, 2009 ; Last updated: April 10, 2021; Small "Fair Use" QUOTE: "Did you know a solar flare can make your toilet stop working? [] That's the surprising conclusion of a NASA-funded study by the National Academy of Sciences entitled Severe Space Weather Events—Understanding Societal and Economic Impacts. In the 132-page report, experts detailed what might happen to our modern, high-tech society in the event of a "super solar flare" followed by an extreme geomagnetic storm. They found that almost nothing is immune from space weather—not even the water in your bathroom. [] "A contemporary repetition of the Carrington Event would cause … extensive social and economic disruptions," the report warns. Power outages would be accompanied by radio blackouts and satellite malfunctions; telecommunications, GPS navigation, banking and finance, and transportation would all be affected. Some problems would correct themselves with the fading of the storm: radio and GPS transmissions could come back online fairly quickly. Other problems would be lasting: a burnt-out multi-ton transformer, for instance, can take weeks or months to repair. The total economic impact in the first year alone could reach $2 trillion, some 20 times greater than the costs of a Hurricane Katrina or, to use a timelier example, a few TARPs. [] What's the solution? The report ends with a call for infrastructure designed to better withstand geomagnetic disturbances, improved GPS codes and frequencies, and improvements in space weather forecasting. Reliable forecasting is key. If utility and satellite operators know a storm is coming, they can take measures to reduce damage—e.g., disconnecting wires, shielding vulnerable electronics, powering down critical hardware. A few hours without power is better than a few weeks." ; "Bottom Line" QUOTE: "At the moment, no one knows when the next super solar storm will erupt. It could be 100 years away or just 100 days. It's something to think about the next time you flush." ; Archive Today cache ; Wayback Machine archive ; Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “RMS Titanic,” from the NEW WORLD ENCYCLOPEDIA: Archive Today cache ; Wayback Machine archive (Nov. 2020) ; Wayback Machine archive (Aug. 2020) ; Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “Titanic Lifeboat,” from SAVY BOAT: Archive Today cache ; Wayback Machine archive YOUR READING ASSIGNMENT: QUOTE: “George Noory has announced a campaign to protect and insulate the U.S. power grid against an EMP (electromagnetic pulse) event or attack via nuclear weapons, ballistic missiles and solar flares, all of which could endanger the lives of millions of Americans. More on the campaign at WND.” Source: “George Noory Launches EMP Protection Campaign,” by News Staff, Coast to Coast: AM, Published Monday, August 04, 2014, LINK (Coast) ; Archive Today ; Wayback Machine ; LINK (Business Wire) ; Archive Today ; Wayback Machine “SECURING THE GRID AGAINST ALL HAZARDS: Severe Weather ; Cyber Attack ; Sabotage ; Solar Storms ; Electromagnetic Pulse,” by Dr. Peter Vincent Pry, EMP Task Force on National and Homeland Security, North Carolina General Assembly, briefings; Published 2-15-2018, LINK ; Cache at Archive Today ; Library at Wayback Machine ; Cache-1 (PDF) at Wayback Machine ; Cache-2 (PDF) at Wayback Machine ; Cache-3 (WebPage) at Wayback Machine ; Cache-4 (WebPage) at Wayback Machine ; Local cache (PDF) ; Cache (PDF) at Mirror 1 ; Cache (PDF) at Mirror 2 ; Cache (PDF) at Mirror 3 ; Local cache (WebPage) ; Cache (WebPage) at Mirror 1 ; Cache (WebPage) at Mirror 2 ; Cache (WebPage) at Mirror 3 “Probability estimation of a catastrophic Carrington-like geomagnetic storm: Re-evaluated in new light of upcoming Maunder Minimum and recent decreases in geomagnetic field, after recent studies came to conflicting conclusions; Proposed solutions for citizens and lawmakers,” by Gordon Wayne Watts, A.S. United Electronics Institute, Valedictorian; B.S. The Florida State University, Biological & Chemical Sciences, Double major with honours, ACADEMIA, Published 10-2-2019; Last updated 10-5-2019; PDF file format: Wayback Machine archive ; Archive Today cache of ACADEMIA.EDU ; Wayback Machine archive of ACADEMIA.EDU ; Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 ; Webpage (*.html) format: Archive Today cache-A ; Archive Today cache-B ; Wayback Machine archive ; Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 ; Microsoft Word (*.doc) format: Local cached copy ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “A Call to Action for America,” A collaborative report by: Task Force on National and Homeland Security, Secure the Grid Coalition, and other partners, EMP Task Force on National and Homeland Security, Updated and Revised, February 2021, LINK ; Cache at Wayback Machine ; Local cache ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 ; TAKEN FROM: “Resources,” by, EMP Task Force on National and Homeland Security, Updated and Revised, February 2021, LINK ; Cache at Archive Today ; Cache at Wayback Machine “BLACKOUT WARFARE: High-altitude Electromagnetic Pulse (HEMP) Attack On The U.S. Electric Power Grid,” by Dr. William A. Radasky and Dr. Peter Vincent Pry, EMP Task Force on National and Homeland Security, Published August 6, 2021, LINK ; Cache at Wayback Machine ; Local cache ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “BLACKOUT WARFARE: Attacking The U.S. Electric Power Grid A Revolution In Military Affairs,” by Dr. Peter Vincent Pry, With An Introduction By Dr. William R. Graham and Ambassador R. James Woolsey, Copyright © 2021 Peter Vincent Pry, ASIN: B09DFK4RYY (KINDLE) ; ISBN-13: 979-8462218309 (Paperback) ; ISBN-13: 978-1087906799 (Hardback), Republished with permission, EMP Task Force on National and Homeland Security, Publication Date: August 22, 2021 (KINDLE), August 23, 2021 (Paperback), September 1, 2020 (Hardcover), AMAZON ; KINDLE ; Barnes & Noble ; GoodReads.com ; AbeBooks ; BOL.com ; Adlibris ; EuroBuch.com ; Cache at Wayback Machine ; Local cache ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 “U.S. risking cybergeddon with Russia: One coordinated cyberattack could shut down 80% of U.S. electrical grid,” by Peter Vincent Pry, The Washington Times, Tuesday, January 18, 2022, LINK ; Cache-1 at Wayback Machine ; Cache-2 at Wayback Machine ; Library at Wayback Machine ; Cache at Archive Today (clipped) ; Cache at Archive Today (repaired) ; Local cache ; Cache at Mirror 1 ; Cache at Mirror 2 ; Cache at Mirror 3 * “Solar storm knocks out 40 newly launched SpaceX satellites,” by Steve Gorman (3 minute read), REUTERS, February 9, 2022, 5:42 PM (EST), LINK ; Archive Today cache ; Wayback Machine archive ; Local archive ; Mirror-1 cache ; Mirror-2 cache ; Mirror-3 cache * “Domestic Electromagnetic Spectrum Operations (DEMSO) Resiliency Guide 2022,” Attribution: This document is a collaborative product of the San Antonio Electromagnetic Defense (SA-EMD), Domestic Electromagnetic Spectrum Operations Working Group, Distribution A: Approved for public release; distribution unlimited, June 2022, LINKS: LINK (*.mil aka "Military" view) ; LINK (*.mil aka "Military" automatic download) ; LINK (adobe.com aka Acrobat Adobe cache) ; Wayback Machine archive ; Local cache ; Mirror-1 ; Mirror-2 ; Mirror-3 * “* BREAKING -- Earth's sun Unexpected increase in solar cycle threatens satellites, GPS, and fragile power / telecommunications grid worldwide,” by Gordon Wayne Watts, The Register, Monday, 04 July 2022, LINK (mirror 1) ; LINK (mirror 2) ; Archive Today cache ; Wayback Machine archive ^ ^ ^ PROBLEMS ^ ^ ^ But we don't merely "gripe," "complain," or "argue" with one another; rather, we offer REAL solutions. v V v SOLUTIONS v V v First, some expired legislation, just so you can see a few good examples of what we mean when we say "Key Legislation":

· H.R.5026 - GRID Act [111th Congress (2009-2010)] –

aka: “Grid Reliability and Infrastructure Defense Act” – Sponsor: Rep. Markey, Edward J. [D-MA-7] (Introduced 04/14/2010), Original cosponsor,

Rep. Upton, Fred [R-MI-6]

· H.R.668 - Secure High-voltage Infrastructure for

Electricity from Lethal Damage Act [112th Congress (2011-2012)] – aka: “SHIELD Act” – Sponsor: Rep. Franks, Trent [R-AZ-2] (Introduced

02/11/2011), Cosponsors – 41 total, 37 Republican, 4 Democrat

· H.R.6221 - Identifying Cybersecurity Risks to Critical

Infrastructure Act of 2012 [112th Congress (2011-2012)] – Sponsor: Rep. Clarke, Yvette D. [D-NY-11] (Introduced 07/26/2012), Cosponsors: 4

total, 3 Democrat, 1 Republican

· H.Res.762 - Expressing the sense of the House of

Representatives regarding community-based civil defense and power generation. [112th Congress (2011-2012)] – Sponsor: Rep. Bartlett,

Roscoe G. [R-MD-06] (Introduced 08/02/2012), Cosponsors listed: (all original cosponsors) Rep. Franks, Trent [R-AZ-2], Rep. Clarke, Yvette D. [D-NY-11],

Rep. Johnson, Henry C. "Hank," Jr. [D-GA-4]

· H.R.2417 - Secure High-voltage Infrastructure for

Electricity from Lethal Damage Act [113th Congress (2013-2014)] – Sponsor: Rep. Franks, Trent [R-AZ-8] (Introduced 06/18/2013), Cosponsors:

31 total, 1 Democrat, 30 Republican

· H.R.2962 - SMART Grid Study Act of 2013 [113th Congress

(2013-2014)] – Sponsor: Rep. Payne, Donald M., Jr. [D-NJ-10] (Introduced 08/01/2013), Cosponsors: 37 total, 32 Democrat, 5 Republican

· H.R.3410 - Critical Infrastructure Protection

Act [113th Congress (2013-2014)] – aka: CIPA – Sponsor: Rep. Franks, Trent [R-AZ-8] (Introduced 10/30/2013), Cosponsors: 21 total, 19

Republican, 2 Democrat

· H.R.4298 - GRID Act [113th Congress

(2013-2014)] – aka: Grid Reliability and Infrastructure Defense Act – Sponsor: Rep. Waxman, Henry A. [D-CA-33] (Introduced 03/26/2014)

· S.1846 - Critical Infrastructure Protection Act

of 2016 [114th Congress (2015-2016)] – aka: CIPA – Sponsor: Sen. Johnson, Ron [R-WI] (Introduced 07/23/2015), Cosponsor: Sen. Ted Cruz

[R-TX]

· S.2232 - Next Generation GRID Act [115th Congress

(2017-2018)] – Sponsor: Sen. King, Angus S., Jr. [I-ME] (Introduced 12/14/2017)

· S.346 - National Evaluation of Techniques for Making

Energy Technologies More Efficient and Resilient Act of 2019 [116th Congress (2019-2020)] – Sponsor: Sen. Hassan, Margaret Wood [D-NH]

(Introduced 02/06/2019), Cosponsors listed: (all original cosponsors) Sen. Sanders, Bernard [I-VT], Sen. Shaheen, Jeanne [D-NH], Sen. Markey, Edward J.

[D-MA]

· S.3688 - Energy Infrastructure

Protection Act of 2020 [116th Congress (2019-2020)] – Sponsor: Sen. Murkowski, Lisa [R-AK] (Introduced 05/12/2020), Cosponsor: Sen. Risch,

James E. [R-ID]

In a letter by coalition members,

including Ambassador R. James Woolsey Jr. (a former CIA Director, and veteran of four presidential administrations) and Michael Mabee (a decorated army

veteran and author of a book on civil defense preparedness, in case the GRID

goes down), they told lawmakers that the bill "appears that it was drafted by the utility industry for the express purpose of codifying the current

“security through obscurity” regime that keeps us vulnerable and betrays the public trust," and went on to offer specific examples:

Among other concerns, they wrote that this bill "codifies a major departure from the original intent for transparency & public disclosure," and,

specifically, that this bill restricts transparency and access to the public by "Exporting the “Security through Obscurity” regime to other government

agencies by offering assistance to those agencies in labeling information as Critical Energy Infrastructure Information (CEII) in order to prevent FOIA

access." (Editor's Note: "FOIA" refers to the Freedom of Information Act, that allows ordinary citizens to get hold of public information from

their government.) "Codifying government inaction and regulatory malfeasance by releasing FERC from any responsibility for untimely processing of FOIA

requests, establishing that FERC’s failure to grant or deny a request after (1) year from submission will automatically designate the requested information

as CEII and for a period of 10 years. (Editor's Note: "FERC" stands for the Federal Energy Regulatory Commission, "NERC" stands for the North American

Electric Reliability Corporation, and "CEII" stands for "Critical Energy Infrastructure Information," i.e., an excuse to claim it is classified, and thus

shielded from the public view.) Codifying government inaction and regulatory malfeasance by releasing FERC from any responsibility for untimely processing of FOIA

requests, establishing that FERC’s failure to grant or deny a request after (1) year from submission will automatically designate the requested information

as CEII and for a period of 10 years. (Editor's Note: This sets the default *against* the public disclosure, making it an uphill battle, and denying

meaningful access to the public regarding safety violations or fines and sanctions by the government.) "Allowing blanket CEII designations for a duration that can be extended at the will of FERC (i.e., forever)" "Allows utilities the freedom not to designate information as CEII until after it becomes the subject of a FOIA request" "Allows FERC to later designate information as CEII that they previously determined wasn’t"; and, finally: "Establishes that FERC may grant CEII to a member of the public only if that member has entered into an NDA with the source of the

information which has been approved by an administrative law judge from DOE or FERC." (Editor's Note: An "NDA" is a non-disclosure agreement, e.g., a

legal ban on disclosing information, and a restriction on one's First Amendment rights of free speech, under the so-called guise of "national security," in

this context.)

Specifically, they claim that "we have observed that since 2010, electric utilities have routinely used CEII as an excuse to conceal violations of law,

inefficiency, and administrative error and to prevent embarrassment. This legislation gives those utilities free reign to expand this repugnant practice

and maintain it indefinitely, to the great detriment of the public. It also prevents a concerned public from utilizing the Freedom of Information Act

(FOIA) to ascertain which utilities have violated standards, broken laws, or put their ratepayers at risk," and cite these four (4)

examples:

Physical Security risks – a year after the now famous April 16, 2013 attack on PG&E’s Metcalf substation, the same substation

was breached in August 20143 and the utility’s director of corporate security said publicly that PG&E has ‘high level security’ at critical facilities”

while reporting internally that “In reality PG&E is years away from a healthy and robust physical security posture.”4 Further obscurity of physical

security violations will only reinforce this type of dishonesty. Safety risks – On July 31, 2009, PG&E was fined $100,000 for violating the transmission vegetation management standard. Then,

after the NERC/FERC coverup began in 2010 there are violations this standard in the Western Interconnection. This is the same location where more than 86

deaths occurred in the “Camp Fire” – the deadliest and most destructive wildfire in California history. It is possible PG&E is a culprit but their identify

remains concealed from public scrutiny.5 Cybersecurity risks – On May 30, 2016 cybersecurity expert Chris Vickery reported a massive data breach by PG&E. On February

28, 2018 NERC issued a “Notice of Penalty regarding Unidentified Registered Entity” in which the NERC-anonymized entity apparently agreed to pay penalties

of $2,700,000 for very serious cybersecurity violations.6 The PG&E data breach in 2016 and NERC’s cover-up of the identity of the “Unidentified Registered

Entity” — who by NERC’s own admission was involved in a dangerous data breach — is ample proof that a watchful regulator is necessary to protect the bulk

power system. Yet, it seems that regulator currently conspires with its Congressional overseers to further insulate the industry and itself from public

scrutiny. Economic risks – PG&E ultimately went bankrupt and now either the rate payer or the taxpayer will foot the bill for their

recovery. In either case, how is it in the public interest that a utility be allowed to incur so many risks and yet be insulated so well from public

scrutiny?

Moral of the story: Don't believe everything you see, hear, or read, concerning these bills, and do your homework, first.

Source: Letter dated June 4,

2020, and addressed to Sen. Angus King (I-ME) and Rep. Mike Gallagher (R-WI-08), by the Secure the Grid

Coalition, Dated June 4, 2020: LINK ;

Wayback Machine archive ; Local cache ;

Mirror-1 archive ;

Mirror-2 archive ;

Mirror-3 archive

KEY RESOURCES (local)

CONTRACT WITH AMERICA: PART II(TM) cross-posted to 5 mirrors in case GRID goes down:

FLAGSHIP MIRROR: https://ContractWithAmerica2.com/#grid

KEY RESOURCES (outside)

EMP TASKFORCE cross-posted to 3 mirrors in case GRID goes down:

SECURE THE GRID COALITION cross-posted to 3 mirrors in case GRID goes down: For further information:

NONE of the bills above were refiled in this current Congress (117th Congress, 2021-2022) by any U.S. Senators or Members of Congress, and some or all of them are very-much needed to avert disaster. Before you contact your (your Congressman/Congresswoman) & your U.S. Senator, see some current legislation, which you should politely but firmly demand they file -- in addition to refiling the expired legislation above.

· H.R.806 - Clean Energy and Sustainability Accelerator

Act [117th Congress (2021-2022)] – Sponsor: Rep. Dingell, Debbie [D-MI-12] (Introduced 02/04/2021), Cosponsors: 12 total, 10 Democrat, 2

Republican

· H.R.1119 - Stopping Chinese Communist Involvement in

the Power Grid Act [117th Congress (2021-2022)] – Sponsor: Rep. Duncan, Jeff [R-SC-3] (Introduced 02/18/2021), Cosponsors: Rep. Mann,

Tracey [R-KS-1] and Rep. Gaetz, Matt [R-FL-1]

· H.R.1514 - To amend the Federal Power Act to increase

transmission capacity for clean energy, reduce congestion, and increase grid resilience. [117th Congress (2021-2022)] – Sponsor: Rep.

Peters, Scott H. [D-CA-52] (Introduced 03/02/2021), Cosponsors listed: Rep. Matsui, Doris O. [D-CA-6], Rep. Casten, Sean [D-IL-6], Rep. Quigley, Mike

[D-IL-5]

· S.704 - Disaster Safe Power Grid Act of 2021 [117th

Congress (2021-2022)] – Sponsor: Sen. Wyden, Ron [D-OR] (Introduced 03/11/2021), Cosponsor: Sen. Merkley, Jeff [D-OR]

· S.2269 - Protect American Power Infrastructure

Act [117th Congress (2021-2022)] – Sponsor: Sen. Scott, Rick [R-FL] (Introduced 06/24/2021), Cosponsors listed: (all original cosponsors) Sen.

Rubio, Marco [R-FL], Sen. Marshall, Roger W. [R-KS], Sen. Cotton, Tom [R-AR] ACTION ITEMS: Contact your (your Congressman/Congresswoman) & your U.S. Senator, and demand they act. You now have bill numbers, which will help their staffers understand your request. But you can speak in plain English too -- asking them to "harden" and "protect" and "upgrade" our fragile Power, Cell Phone, Computer, & Internet GRID. You can call them, and contact them through their Congressional and Senatorial webpages (look for contact links), as well as their social media. A personal visit would not hurt either, but be polite and well-prepared. And persistent.

ACTION ITEMS -- Recommendations for citizens: What can I do?

• Have plenty of canned and non-perishable food & drink stored, manual can openers, water for bathing & flushing the toilet, as well as potable drinking

water. Peanut butter is an especially good source of fats, proteins, and carbohydrates, and has a long shelf life. (Include Emergency First Aid Kits,

prescription and over-the-counter meds, as needed, and also personal items like soap, shampoo, and plenty of toilet paper and/or wash cloths, if you run

out of toilet paper—and spare clothing & underwear.) AND -- Offer these proposals to lawmakers -- to supplement the above:

• Local voltage surge protection devices and/or filters, and even “double-surge” protection in critical electric power, communications, and military

infrastructure; Require critical infrastructure to also include EMP power line transient suppressors;

You may also donate if you can't do anything else; that is critical since we are taking time off from "paying" jobs to do this much-needed volunteer work. Nonetheless, it is even more important to politely, but firmly (and consistently) demand our over-paid, under-performing lawmakers (who make around $200 GRAND per year -- much more than our staff) to do their job: FILE THE BILLS ALREADY, and stop merely sucking down our taxpayer dollars. ACTION ITEMS: Contact your (your Congressman/Congresswoman) & your U.S. Senator, and demand they act. You now have bill numbers, which will help their staffers understand your request. But you can speak in plain English too -- asking them to "harden" and "protect" and "upgrade" our fragile Power, Cell Phone, Computer, & Internet GRID. You can call them, and contact them through their Congressional and Senatorial webpages (look for contact links), as well as their social media. A personal visit would not hurt either, but be polite and well-prepared. And persistent.

You may also donate if you can't do anything else; that is critical since we are taking time off from "paying" jobs to do this much-needed volunteer work. Nonetheless, it is even more important to politely, but firmly (and consistently) demand our over-paid, under-performing lawmakers (who make around $200 GRAND per year -- much more than our staff) to do their job: FILE THE BILLS ALREADY, and stop merely sucking down our taxpayer dollars. ACTION ITEMS: Contact your (your Congressman/Congresswoman) & your U.S. Senator, and demand they act. You now have bill numbers, which will help their staffers understand your request. But you can speak in plain English too -- asking them to "harden" and "protect" and "upgrade" our fragile Power, Cell Phone, Computer, & Internet GRID. You can call them, and contact them through their Congressional and Senatorial webpages (look for contact links), as well as their social media. A personal visit would not hurt either, but be polite and well-prepared. And persistent.

You may also donate if you can't do anything else; that is critical since we are taking time off from "paying" jobs to do this much-needed volunteer work. Nonetheless, it is even more important to politely, but firmly (and consistently) demand our over-paid, under-performing lawmakers (who make around $200 GRAND per year -- much more than our staff) to do their job: FILE THE BILLS ALREADY, and stop merely sucking down our taxpayer dollars. ACTION ITEMS: Contact your (your Congressman/Congresswoman) & your U.S. Senator, and demand they act. You now have bill numbers, which will help their staffers understand your request. But you can speak in plain English too -- asking them to "harden" and "protect" and "upgrade" our fragile Power, Cell Phone, Computer, & Internet GRID. You can call them, and contact them through their Congressional and Senatorial webpages (look for contact links), as well as their social media. A personal visit would not hurt either, but be polite and well-prepared. And persistent.

Click *_here_* to jump back to the top of the page.

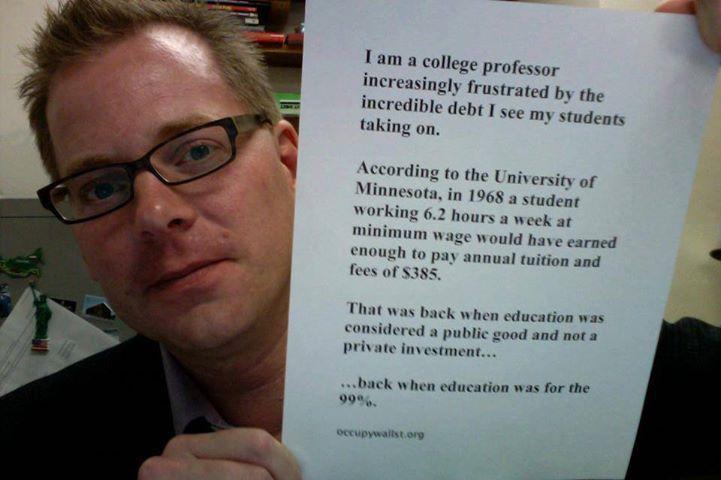

How are we to pay for much-needed upgrades to THE GRID and other key infrastructure (roads & bridges, for example) if we don't cut unnecessary "Pork" spending excesses? Here's how: Now, there is much unnecessary and wasteful "pork" spending, as shown -- for example -- in research done by OpenTheBooks.com. As well, the annotated video, above, of an old public "Tele-Town Hall" meeting with former Lakeland, Fla. Congressman, Dennis A. Ross, a Republican, is a perfect example of why we still have an "over-spending" problem: He agrees that taxpayer dollars should not be used to "make" or "back" (guarantee) student loans. However, he never filed any bills to even attempt such! (And, neither has ANY lawmaker in EITHER party!) Why is this important, you might ask? In any recent analysis of a budget (a few recent examples here), only ONE thing can safely be cut:

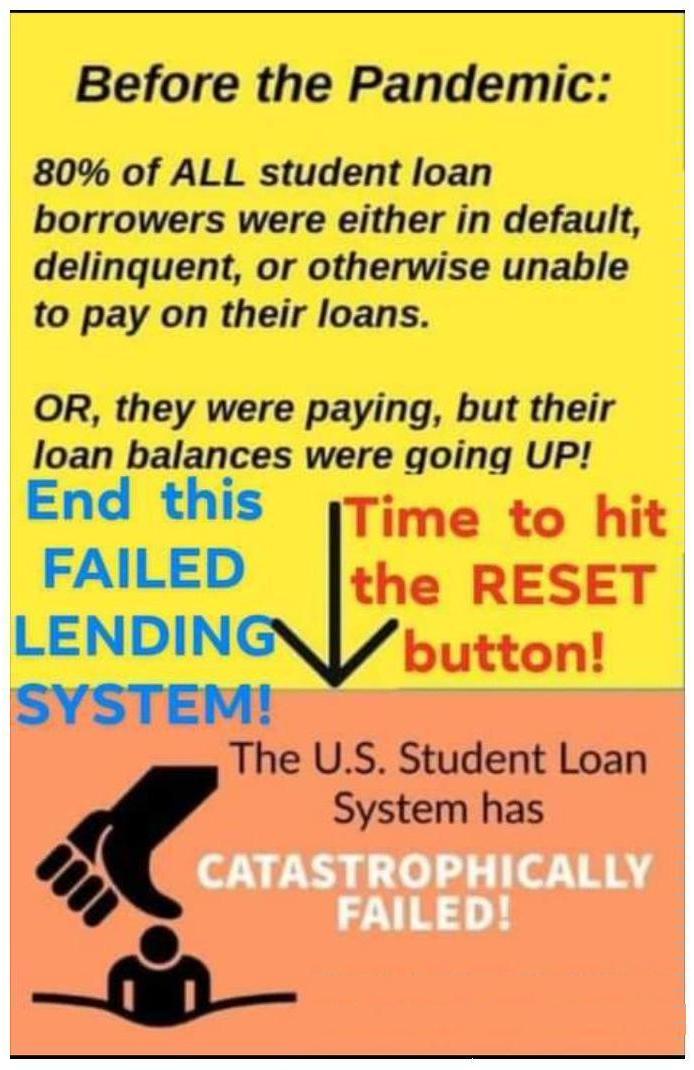

There is only ONE (1) 'sizable' thing we can cut in the current budget in outlays, e.g., spending: STUDENT DEBT, which comprises almost TEN (10%) PERCENT

of total U.S. Debt, almost $2 Trillion ÷ $20 Trillion --or a "few trillion" more, now with COVID-19 economic spending: “Today, FSA's [student debt]

portfolio is nearly 10 percent of our nation's debt. [] Stop and absorb that for a moment. Ten percent of our total national debt.”

Source: U.S. Dept of Education, Sec. of Education, Betsy DeVos, 11-27-2018 speech: YES: Almost Two Trillion ($2,000,000,000,000.oo) of YOUR taxpayer dollars were used to make or back student loans. Not only is this quite costly, but it is not even helpful: In fact, it is harmful: Colleges simply raise the price of tuition when they have "easy access" to "deep pockets" loans from the taxpayers, who function as a de facto "Sugar Daddy" to make colleges and universities rich: The student functions as merely a "pass-through" or "conduit" for this massive wealth transfer. Thus, it should NOT be called "student aide," but rather "rich college aide." UPDATE: Besides being dangerous fiscal policy, this profligate overspending to originate (make) student loans is also patently prohibited by the Republican Party's official platform, so all GOP lawmakers who do not fall in line, and immediately file legislation (shown below) to stop this, are "RINO" Republicans (Republicans In Name Only), and are directly and immediately responsible for the subsequent "crash of the dollar" that will result if no action is immediately taken. QUOTE: On page 35 of the Republican Party Platform, we see the GOP clearly says: “The federal government should not be in the business of originating student loans.” (1ST sentence of last paragraph, near bottom-right of page) [Editor's Note: This is page 42 of 66 of “PDF” page numbers, but the writer labels this as page “35,” since the first 7 pages weren't given regular page numbers. This author could not find a more current version, such as 2020 or more recent.] Source: “REPUBLICAN PLATFORM 2016,” used under Fair Use for commentary, criticism, and research. LINK ; Wayback Machine ; Local cache ; Archive-1 ; Archive-2 ; Archive-3 See also-- QUOTE: "So, the summary of this investigation is that practically ZERO Republican lawmakers (or maybe 8.14%, when being very generous with the definition of compliance) actually even **attempt** to obey our party's platform..." Source: “*** OPEN INVESTIGATION *** Lawmakers who don't follow their own party platforms: What percentage of lawmakers in each political party obey their own party's platform in key higher ed funding legislation? Almost zero, and this threatens to crash the U.S. Dollar if not stopped.,” by Gordon Wayne Watts, The Register, Tuesday, 07 June 2022: LINK ; Archive-1 ; Archive-2 ; Archive-3 ; Archive Today ; Wayback Machine ; PDF format: LINK ; Archive-1 ; Archive-2 ; Archive-3 ; Wayback Machine

$$$ CRASH of the DOLLAR WARNING: Failure to pay close attention here -- and here on out -- WILL result in a CRA$H of the U.S. DOLLAR! Do NOT say you weren't warned: We are warning you right here and now. $$Two Trillion Dollars is a LOT of money! ** We go almost THREE-HUNDRED MILLION ($300,000,000.oo) DOLLAR$ per DAY in debt due to Lawmakers' refusal to STOP harmful pork subsidies to make/back UNNECESSARY higher ed loans ** You heard right on both counts: Since college was almost FREE in America in the very recent past, there WERE no student loans, and thus no student loan debt -- and, by logical extension, no need for taxpayers to subsidize said debt, thus no need for these subsidies exists now. Moreover, numerous fiscally-responsible lawmakers (read: YOU) (allegedly) want to cut wasteful pork spending: However, we haven't been able to, and here is math supporting this claim: A 2014 article in the NY Times claims that: “A decade ago, there was only about $300 billion in such loans outstanding, and even now the $1.1 trillion in student loan debt is dwarfed by mortgage debt. But people who borrow money to pay for their education can’t simply walk away without paying, unlike with mortgages, car loans or credit cards; there is no equivalent of foreclosure, and student loan debts aren’t cleared by bankruptcy.” Source: “The Role of Student Debt in Stunting the Recovery,” by Neil Irwin, The New York Times, May 14, 2014: LINK ; Archive Today cache ; Wayback Machine archive ; Local Cache (via Archive Today with Federal Reserve graph "Proportion of 27- to 30-year-olds with a home mortgage") ; Local Cache (via Wayback Machine with Reuters photo of construction site) ; Mirror-1 archive (via Archive Today) ; Mirror-1 archive (via Wayback Machine) ; Mirror-2 archive (via Archive Today) ; Mirror-2 archive (via Wayback Machine) ; Mirror-3 archive (via Wayback Machine) ; Mirror-3 archive (via Archive Today) If a there were only $300 billion in student loans in 2004 (a decade before the 2014 article), and we're approaching almost $2 Trillion now, then we see that we've added $1.7 Trillion to U.S. Debt (we currently are the sole lenders of all student loans) in a space of sixteen (16) years: That's $106,250,000,000.oo, or more than $100 Billion per year, or about $290,896,646.13 every single day! (That does not even count the interest, which is not negligible!) Lawmakers' refusal to act upon this reasonable legislation, above, is directly and immediately responsible for adding almost 300 MILLION dollars to the national debt EVERY SINGLE DAY—and this WILL crash the dollar is left unchecked. Why haven't lawmakers been unable to stop “spending hemorrhaging” –bleeding to death!? ANSWER: Look again at the NY Times article: Student debt is practically impossible to discharge in bankruptcy. Bankruptcy is the “Economic Second Amendment” – a means of defending against illegal price-gouging, and the requisite wasteful use of our taxpayer dollars to make or guarantee such loans. PROOF: Bankruptcy operates as a Conservative Free Market “check” on predatory lending—by making the lender “think twice” before loaning out (read: WASTING) huge Trillions of your tax dollars. Put another way: If college students could defend via Student Loan Bankruptcy (H.R.2648 and S.1414, from last session), then this would scare the Dept of Education (the sole lender) into STOPPING its insane loaning of obscenely-high Student Loans (using YOUR taxpayer dollars), via obvious Free Market Forces (student's self-defense abilities), and thus Higher Ed lobbyists would see the “handwriting on the wall,” regarding their push to increase loan limits—and give up—thus allowing President Trump's legislative request for pork spending cuts: loan limits are spending cuts, as they use YOUR tax dollar$$, above —see discussion quoting Sen. Rick Scott (R-FL), who agrees with this analysis. If YOU disagree with me, dear reader, then please explain why even GOP lawmakers haven't attempted to enact Trump's spending cuts? ( – crickets – ) My answer is correct: Only WITH Student Loan Bankruptcy defense restored (as it was, in the past, and worked well then) would Mr. Trump (or currently-elected Conservative politicians) have a “fighting chance” of getting lawmakers to pass his pork spending cuts request, as described elsewhere in this section. THEREFORE: Returning bankruptcy to student loans (or something similarly “shocking” to the system—such as an 'en mass' Jubilee Forgiveness of part—or all—of student debt—as Alan Collinge's “Million Signature” petition seeks -- if it somehow crashes the lending apparatus, thus saving tax dollars from being bled out & wasted, as I hope it would) is the ***ONLY*** way to achieve this goal here—cutting of wasteful pork spending, so we can fund other, much-needed, projects (infrastructure, protecting the grid, military and police pay raises, etc.). To that end, lawmakers, please pass both the proposed pork spending cuts bill linked above and student loan bankruptcy defense, the "de facto" "Economic Second Amendment," a Conservative Free Market check/balance on unnecessary pork spending. In fact, colleges and universities didn't really begin to price-gouge students until over-eager lawmakers made sure that students had easy access to taxpayer-funded student loans. (Back when college was affordable -- or free in some places -- there was no need for taxpayer-funded Student Loans; indeed, there was no need for student loans AT ALL: College was affordable -- and free in places. Yet, lawmakers of both parties were over eager to provide a solution to a non-existent problem.) COLLEGE WAS ONCE FREE IN AMERICA: PROOF Whether you like “Liberals” like Sen. Bernie Sanders (I-VT) or “Conservatives” like Sen. Rick Scott (R-FL), both agree that colleges was once FREE—or VERY close to it, in the past: REPUBLICAN Senator Rick Scott: “When I went to college in the 70’s, tuition was as low as $200 a semester, with no fees that I can remember.” Press Release dated Tue. 10 Sept. 2019: Archive Today cache ; Wayback Machine archive ; Mirror 1 archive ; Mirror 2 archive Assuming this was January of 1975, this would be equivalent to $987.89 per semester in an October 2019. Source: BLS.gov calculator And, WestEgg's calculator gives a similar conversion: “What cost $200 in 1975 would cost $943.89 in 2018.” In fact, PolitiFact rated as “Mostly True” DEMOCRAT SENATOR Bernie Sanders' claim that college was once “free” in the United States: “There was a time in the United States when some public colleges and universities charged no tuition. However, tuition has never been set as a national policy -- it is a decision for each school or state government officials. And some colleges charged tuition dating back to the 1800s. [] Sanders' statement is accurate but needs clarification. We rate this statement Mostly True.” Source: “Was college once free in United States, as Bernie Sanders says?,” by Amy Sherman, PolitiFact, 09 February 2016: Archive Today cache ; Wayback Machine archive ; Mirror 1 archive ; Mirror 2 archive Historians will recognize this phenomenon as the "Bill Bennett Hypothesis": When you subsidize anything with taxpayer dollars, costs go up. Conservatives have, for years —for decades— have complained about excess spending of taxpayer dollars to make or guarantee student loans: “If anything, increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that Federal loan subsidies would help cushion the increase.” Source: “Our Greedy Colleges,” By Dr. William J. “Bill” Bennett, former Secretary of Education under President Ronald Reagan, The New York Times, 18 February 1987: Archive Today cache ; Wayback Machine archive More-recently, President Trump called on lawmakers to curb this harmful pork spending: “Trump Proposes Limits On Student Loan Borrowing,” By Zack Friedman, FORBES, Tue. March 19, 2019: Google Amp cache ; Archive Today cache ; Wayback Machine archive In fact, the list of supporters for this -- and other -- spending cuts is quite long, and even includes some Democrats, at the very least, Rep. Darren Soto (D-FL-09). SOURCE: PRESS RELEASE: “IN FLOOR SPEECH, SOTO REJECTS REPUBLICAN DEFICIT-EXPLODING BUDGET, CALLS ON FREEDOM CAUCUS DEBT BETRAYAL,” by Rep. Darren Soto (D-FL-09), Washington, DC, October 26, 2017: Archive Today cache ; Wayback Machine archive ; Other archives- Mirror-1 ; Other archives- Mirror-2 To see a full list of supporters of PORK SPENDING CUTS (PDF file format), here is a partial list:

To see a full list of related research docs in the "root folder":

So, all these lawmakers (particularly GOP lawmakers) are "talking a big talk," but not "walking the walk." Therefore, all true Conservatives (who claim to oppose harmful pork spending excesses) and even many like-minded Liberals (who rightly see how such "student loan" subsidies result in HIGHER costs of college, not lower -- in addition to soaking the taxpayer, and placing undue student debt burdens on the backs of poor college students -- something which did NOT happen just a few decades back!), should take a 2nd look at the last 2 pages of the PORK SPENDING CUTS (PDF file format) research linked above. Here, you will find 2 versions of a bill that does precisely what almost all Republicans and many Democrats claim is needed: Either a reduction or elimination of said subsidies. One version is merely a "loan limits" bill that reverses Student Loan limits back to previous levels (which is a spending cuts: YOUR tax dollars are used).

The other version of this bill [[see PDF, here: There are two (2) versions]] is an extreme -- but necessary -- measure to prohibit and eliminate tax dollars whatsoever, a drastic measure which might not be "politically" possible, as Higher Ed Swamp creatures, who get said corporate handouts therewith, would experience extreme withdrawal symptoms. However, both versions of this bill are linked above. VERY IMPORTANT: As no lawmaker -- of either party -- has the guts or gumption to file said bill, there IS no "bill number" to reference, but both versions of the proposed bill, linked above, are "grammatically correct," insofar as they properly reference U.S. Code and reverse the harmful effects of §422 of H.R.507 (109th CONGRESS), the “College Access and Opportunity Act of 2005,” a chief cause of this crippling & massive college debt, which American college students are currently experiencing—and which costs taxpayers, who make and/or back such loans. NEW: While the above bill would be optimal, nonetheless, a less elegant (but more complete and extreme) solution exists: Elimination entirely of the U.S. Department of Education (which would throw higher ed back to the states). This would, necessarily, eliminate the lending apparatus (as does the proposed bill above), thus solving several problems: Would save trillions in taxpayer dollars AND would force colleges to stop insane price-gouging & tuition inflation (when colleges realise students no longer have "deep pockets" loans). However, that said, the bill below does not seem to have much political viability. Nonetheless, it is an actual filed bill (with a bill number) and apparently more popular amongst lawmakers than the simpler subsidy cuts bill proposed above. Without further ado, here is said bill:

· H.R.899 - To terminate the Department of

Education. [117th Congress (2021-2022)] – Sponsor: Rep. Massie, Thomas [R-KY-4] (Introduced 02/05/2021), Cosponsors: Sixteen (16) Republican

cosponsors [not listed for brevity]

· S.323 - A bill to terminate the Department of

Education. [117th Congress (2021-2022)] – Sponsor: Sen. Paul, Rand [R-KY] (Introduced 02/12/2021) NEW: While the proposals below, from Sen. Rick Scott's (R-FL) recent Tuesday, September 10, 2019 PRESS RELEASE, are lengthy and detailed (and have no bill number), they actually would work well (especially #4., the price-control measure which is enforced by subsidy cuts), and his press release is quite humourous, too, using ALL CAPS in point #3., below. So, I'll reciprocate: but there's just one problem. Senator Rick Scott, while proposing excellent ideas, has done ABSOLUTELY NOTHING to file legislation as he promised. Nonetheless, these are good ideas, and we list them in order to give readers a chance to politely, but firmly, demand Sen. Scott (and other lawmakers) keep their promises. Without further ado, here is said press release:

Source: "Press Release," dated Tue. 10 Sept. 2019: By U.S. Sen. Rick Scott (R-FL), SENATE.gov, Links: Senate.gov ; Archive Today cache ; Wayback Machine archive ; Local cache ; Mirror-1 archive ; Mirror-2 archive ; Mirror-3 archive QUESTION: Why hasn't Sen. Rick Scott even attempted his grand plan, above? ANSWER: Without the "threat of bankruptcy" defense, the Dept of Ed has NO motives to behave, and pressure from greedy higher-ed lobbyists is too much--even for Rick Scott. Anyone who disagrees, please "explain me" why Scott hasn't acted. Otherwise, please support Constitutional bankrupcy uniformity to force back lobbyists, let them see the "handwriting on the wall," and make the Senator's grand plan politically viable. Again, great ideas, and "big talk" but NO WALK from Sen. Rick Scott (R-FL). Therefore, readers should politely but firmly, demand Sen. Scott (and other lawmakers) keep their promises: See below... ACTION ITEMS: Contact your (your Congressman/Congresswoman) & your U.S. Senator, and demand they act. You now have a copy of the bill that needs to be filed (see above, print it out, save a copy, and send it to your lawmakers). This will help their staffers understand your request. But you can speak in plain English too -- asking them to CUT PORK SPENDING -- particularly, please stop using MY tax dollars to make or guarantee student loans to students who don't needs them, can't afford them, and are actually HARMED by said student "aid." You can call them, and contact them through their Congressional and Senatorial webpages (look for contact links), as well as their social media. A personal visit would not hurt either, but be polite and well-prepared. And persistent.

You may also donate if you can't do anything else; that is critical since we are taking time off from "paying" jobs to do this much-needed volunteer work. Nonetheless, it is even more important to politely, but firmly (and consistently) demand our over-paid, under-performing lawmakers (who make around $200 GRAND per year -- much more than our staff) to do their job: FILE THE BILLS ALREADY, and stop merely sucking down our taxpayer dollars. ACTION ITEMS: Contact your (your Congressman/Congresswoman) & your U.S. Senator, and demand they act. You now have a copy of the bill that needs to be filed (see above, print it out, save a copy, and send it to your lawmakers). This will help their staffers understand your request. But you can speak in plain English too -- asking them to CUT PORK SPENDING -- particularly, please stop using MY tax dollars to make or guarantee student loans to students who don't needs them, can't afford them, and are actually HARMED by said student "aid." You can call them, and contact them through their Congressional and Senatorial webpages (look for contact links), as well as their social media. A personal visit would not hurt either, but be polite and well-prepared. And persistent.

Click *_here_* to jump back to the top of the page.

We must ask "why" NO lawmakers (no, not even so-called "Conservative" GOP Republican lawmakers) have even attempted to make the much-needed pork spending cuts described above in point #2 -- and which they almost-uniformly claim they support. Here is a Free Market solution, to which even legendary Conservative talk show host, the late Rush Limbaugh, does not disagree: Annotated video is in STEREO -- caller & room audio (LEFT), and radio show & host (RIGHT) -- speakers on: STEREO Now, it is a "given" that part of the reason GOP Lawmakers failed to do what they claimed to support is "partly" due to lack of honour, spine, and courage. (That is a polite description, thank you!) However, that can not completely or fully account for their lack of action. After careful reflection, it is obvious that the lack of Bankruptcy Uniformity (as required by the U.S. Constitution's legendary "Uniformity clause," Art. I, Sec.8, clause 4) is the chief and main reason. (Anyone who disagrees, please give us a **better** explanation of why GOP lawmakers REFUSE to make said pork spending cuts; silence is acknowledgment that the aforementioned assessment is correct.) CAVEAT: This point, "III. Using selected Free Market measures," specifically BANKRUPTCY UNIFORMITY, is the "lynchpin," the Sine Qua Non, indispensable and required element -- and while arguably probably not "as important" as protecting the Power/TelComm grid (and dependent 911 cell, power, & Internet web), nonetheless, U.S. CONSTITUTIONAL BANKRUPTCY UNIFORMITY is the nexus -- the one "required" element, without which this entire effort will fall apart, and -- along with it -- our nation, so you have been given fair warning and notice: Now is the time to pay attention. UPDATE: Besides being a violation of the U.S. Constitution's BANKRUPTCY UNIFORMITY clause (Art.I, Sec.8, cl.4), the restoration of bankruptcy as a means to make things "fair" for students is also specifically REQUIRED by the Democrat Party's official platform, so all Democrat lawmakers who do not fall in line, and immediately file legislation (shown below) to stop this, are "DINO" Democrats (Democrats In Name Only), and are directly and immediately responsible for the subsequent "crash of the dollar" that will result if no action is immediately taken to put a stop to this dangerous Higher Ed bubble. QUOTE: On page 71 of the 2020 Democratic Party Platform, we see they clearly say that: “Democrats will also empower the CFPB to take action against exploitative lenders and will work with Congress to allow student debt to be discharged during bankruptcy.” (p.72, par.1, sentence 2) [Editor's Note: This is page 72 of 92 of “PDF” page numbers, but the writer labels this as page “71,” since there's a title page that offsets numbering by one.] Source: “2020 Democratic Party Platform,” used under Fair Use for commentary, criticism, and research. LINK ; Wayback Machine-A ; Wayback Machine-B ; Local cache ; Archive-1 ; Archive-2 ; Archive-3 See also-- QUOTE: "So, the summary of this investigation is that... [only] roughly 18.1% of all Democrat lawmakers actually even **attempt** to obey their party's platform calling for the restoration of student loan bankruptcy self-defense." Source: “*** OPEN INVESTIGATION *** Lawmakers who don't follow their own party platforms: What percentage of lawmakers in each political party obey their own party's platform in key higher ed funding legislation? Almost zero, and this threatens to crash the U.S. Dollar if not stopped.,” by Gordon Wayne Watts, The Register, Tuesday, 07 June 2022: LINK ; Archive-1 ; Archive-2 ; Archive-3 ; Archive Today ; Wayback Machine ; PDF format: LINK ; Archive-1 ; Archive-2 ; Archive-3 ; Wayback Machine OK, as alleged above, the "pork" spending cuts did not happen in large part due to the lack of Bankruptcy Defense -- as enshrined in the U.S. Constitution, but how or why is this relationship true? Well, lawmakers are clearly and obviously bullied, threatened, and bribed (legal "bribes" via campaign contribs) by "powerful" Higher Education lobbyists, who benefit when "loan limits" are set unrealistically high, allowing taxpayers to provide over $2 TRILLION DOLLAR$ of your tax dollars to students, who function as a "pass-through" or "conduit" (unwilling tools) of said massive wealth transfer -- from taxpayer (you) to Higher Ed interests (colleges, universities, all with bloated budgets and salaries). Thus, there is an interest in keeping this sordid relationship at a "status quo." However, were students able to defend via Bankruptcy Defense, as the Constitution requires, this would "send a message" to lobbyists to "back off"; The "loan limits" as set by §422 of H.R.507 (109th CONGRESS), the “College Access and Opportunity Act of 2005” (which the above point seeks to reverse) would be "frustrated: Even if allowed "by law," the student borrowers would become "loan risks" with new-found "Self defense" abilities of Bankruptcy Uniformity -- and -- via the obvious Free Market pressures, here -- lenders would "back off," and lobbyists would see the "handwriting on the wall," and -- likewise -- back off. This would, of course, make Bankruptcy Uniformity possible. A combination of loan limits (aka spending cuts, as your tax dollars are used -- see point II, above), and bankruptcy uniformity (this point, here: Number III.) would force "from both ends" a reduction in higher ed subsidies using your tax dollars. The effects of this would be (at the least) three-fold:

NEW: -- PROOF of THIS: QUOTE: “A recent study by The Harris Poll finds Americans overwhelmingly support multiple reforms for the student loan debt crisis...Frequently recommended solutions, such as forgiveness of a flat amount of student debt (64%) and forgiveness of all student loan debt (55%), are supported by more than half the country. Additionally, nearly two-thirds of Americans (63%) support forgiveness of all student loan debt for those working in certain industries like health care, science & technology, or public service. [] Moreover, Americans show very strong support for other potential solutions including lower interest rates on students that attend public universities (83%), automatic student loan forbearance if someone loses employment (72%), and updating bankruptcy laws to get rid of student debt (66%). [] Americans also supported changes to the cost of a university education. Such solutions included restrictions or price controls on the cost of a university education (78%), no tuition at public colleges or universities (59%), no tuition for undergraduate schooling (56%), and no tuition for any U.S. college or university (53%).” Editor's Note: Bold-faced red font added for clarity; not in original. Double brackets [] denote line-break. Source: “Americans Overwhelmingly Support Student Debt Reform: The majority of Americans support reforms to student loans and education costs, and most think the new presidential administration is up to the task.,,” The Harris Poll, December 2020: LINK ; Archive Today cache ; Wayback Machine archive ; Local cache ; Archive-1 ; Archive-2 ; Archive-3 There is wide-spread, and bipartisan, support for Bankruptcy Uniformity among both lawmakers and political experts --including (but not limited to) the following: Rep. Glenn S. Grothman (R-WI-06th) – Conservative Republican: “Primary Sponsor” of H.R.5899 - To amend title 11 of the United States Code to make debts for student loans dischargeable., 116th Congress (2019-2020), Rep. John Katko (R-NY-24th) – Conservative Republican, and a former Federal Prosecutor: “Primary Sponsor” of H.R.770 - Discharge Student Loans in Bankruptcy Act of 2019, 116th Congress (2019-2020) – –as well as an “Original cosponsor” of H.R.2648 - Student Borrower Bankruptcy Relief Act of 2019, 116th Congress (2019-2020) – –as well as an “Original cosponsor” of H.R.2366 - Discharge Student Loans in Bankruptcy Act of 2017, 115th Congress (2017-2018) – –as well as a cosponsor of H.R.449 - Discharge Student Loans in Bankruptcy Act of 2015, 114th Congress (2015-2016), Rep. Ralph Norman (R-SC-05th) Conservative Republican: “Original cosponsor” of H.R.5899 - To amend title 11 of the United States Code to make debts for student loans dischargeable., 116th Congress (2019-2020), and Rep. Matt Gaetz (R-FL-01st) Conservative Republican (who gave an eloquent defense at the last markup committee meeting for H.R. 2648, from a previous session) -- as well as Rep. Matt Gaetz (R-FL-01st) Conservative Republican. Lawmakers (of both parties) who support common sense Bankruptcy Uniformity keep getting reelected. Historians will recall that things worked "just fine" back when College Student borrowers had bankruptcy defense. We compare bankruptcy defense with the 2nd Amendment: Predatory lending, tuition inflation, and the resulting costly taxpayer-funded subsidies were STOPPED before they started due to students who wielded the "Sword of Bankruptcy, but over-eager lawmakers meddled in the Free Market and made a mess when they made students defenseless. Thus Bankruptcy is now christened the "Economic 2nd Amendment," and rightly so. We know that "Liberals" support student loan bankruptcy, but all true "Conservatives" do as well -- and rightly recognise that Bankruptcy is NOT a Liberal "Free Handout," but rather a Constitutionally-guaranteed right: “Bankruptcy Could Help Millions Struggling Under Student Debt: In 2005, Congress took this one possible life raft away. Why?,” by Jon Basil Utley, publisher of The American Conservative, published in The American Conservative, January 23, 2020: REVIEW ; AUTHOR PROFILE ; Their byline states: “The American Conservative exists to advance a Main Street conservatism. We cherish local community, the liberties bequeathed us by the Founders, the civilizational foundations of faith and family, and—we are not ashamed to use the word—peace.” Archive Today cache ; Wayback Machine archive ; Local archive ; Mirror-1 cache ; Mirror-2 cache ; Mirror-3 cache ; Mirror-4 cache Ike Brannon of the Cato Institute: “Let Them Go Bankrupt,” by IKE BRANNON, The Weekly Standard, February 12, 2016 at 1:15 AM: “5 MIN READ”: Washington Examiner column ; Archive Today cache-A ; Archive Today cache-B ; Wayback Machine Archive-A ; Wayback Machine Archive-B ; Archive-C ; Archive-D New York Times columnist David Brooks: QUOTE: “I think they [the Wall Street Protests] do tap into a couple real issues. Student loans is talked about a lot. And you [should] be able to declare bankruptcy from student loans. You should be able to get out of them under — and the second thing is Wall Street.” Source: “Shields, Brooks on Romney’s Electability, Cain’s 9-9-9 Plan, Wall St. Protests,” PBS, Oct 7, 2011: Archive Today cache ; Wayback Machine archive ; Mirror-1 archive ; Mirror-2 archive National Review, founded by well-known Conservative, William F. Buckley Jr., is calling for allowing student loans to be dischargeable in bankruptcy: “An Idea for Student Loans: Get Rid of Them: It’s time to shut down the Bank of Uncle Stupid.,” By KEVIN D. WILLIAMSON, National Review, April 18, 2019; 6:30 AM; Quotes: “The federal government should stop making college loans itself and cease guaranteeing any such loans” and: “make student-loan debt dischargeable in ordinary bankruptcy procedures.”: Archive Today cache ; Wayback Machine archive ; Mirror-1 archive ; Mirror-2 archive From Frank H. Buckley, a Foundation Professor at Conservative Antonin Scalia Law School of Law at George Mason University and author of “The Republican Workers Party: How the Trump Victory Drove Everyone Crazy, and Why It Was Just What We Needed.”: “The silver bullet for student debt: Bankruptcy,” By Frank H. Buckley, The Washington Post, August 22, 2018: Archive Today cache ; Wayback Machine archive ; Mirror-1 archive ; Mirror-2 archive Jerome Powell, a Conservative Republican, former private equity executive, and current incumbent Chair of the Federal Reserve, who served under Presidents Barack Obama and Donald Trump, agrees: QUOTE: “Federal Reserve chairman Jerome Powell has said he's "at a loss to explain" why student loans are treated differently than other types of debt in bankruptcy.” Source: “Big changes could be in store for student loan borrowers,” by Annie Nova (Twitter: @ANNIEREPORTER), CNBC, Published Friday, October 25, 2019, at 9:44 AM (EDT), UPDATED Saturday, October 26, 2019, at 12:07 PM (EDT), Archive Today cache ; Wayback Machine archive ; Mirror-1 archive ; Mirror-2 archive QUOTE: “Powell said he generally supports the idea of a vibrant education loan climate, but added that borrowers need to be informed of the risks they're taking. [] He also wondered why student debt can't be discharged in bankruptcy. [] "I'd be at a loss to explain why that should be the case," he said, while acknowledging that the issue is one for Congress to tackle. [] While Powell said he couldn't quantify what the longer-run economic effects would be, he said there is danger down the road.” Source: “Student debt could hold back economic growth, should be discharged in bankruptcy, Fed chief says,” by Jeff Cox (Facebook: @JEFF.COX.7528, Twitter: @JEFFCOXCNBCCOM), CNBC, Published Thursday, March 01, 2018, at 11:37 AM (EST), UPDATED Thursday, MAR 01, 2018, at 1:59 PM (EST), Archive Today cache ; Wayback Machine archive ; Mirror-1 archive ; Mirror-2 archive QUOTE: “The new chairman of the Federal Reserve questioned why struggling borrowers can’t discharge their student loans in bankruptcy. [] “Alone among all kinds of debt, we don’t allow student loan debt to be discharged in bankruptcy,” Jerome Powell told members of the Senate Banking Committee Thursday. “I’d be at a loss to explain why that should be the case.” [] Powell’s comments came in response to a question from Senator Brian Schatz, a Democrat from Hawaii, about whether high levels of student debt create a drag on the economy. More than 40 million Americans hold nearly $1.4 trillion in outstanding student loans.” Source: “New Fed chair doesn’t understand why student debt can’t be discharged in bankruptcy: ‘Alone among all kinds of debt, we don’t allow student loan debt to be discharged in bankruptcy’,” by Jillian Berman, MarketWatch, Published: March 04, 2018, at 11:22 a.m. (EST), Archive Today cache ; Wayback Machine archive ; Mirror-1 archive Mirror-2 archive 44.7 Million Americans with student debt -- and another 40-50 Million who are cosigners, family, & friends (upwards of >100+ Million Americans) probably agree:

To see a full list of supporters of BANKRUPTCY UNIFORMITY (PDF file format), here is a partial list:

To see a full list of related research docs in the "root folder":

VERY IMPORTANT: While this is a "political" (and not "religious") project, nonetheless, almost all of our readers have some sort of religion, and it should be noted that the TOP THREE (3) RELIGIONS all support the concept of the "Golden Rule," meaning that if rich lawmakers (and their rich lobbyist friends) wish to have Bankruptcy Defense for themselves, then GOD ALMIGHTY demands that they afford others the same:

ADDENDUM: PROOF THAT REMOVAL OF BANKRUPTCY WAS NOT JUSTIFIED BY BANKRUPTCY ABUSE: Back when student loans were treated the same as all other loans in bankruptcy court, only about zero-point-three (0.3%) percent were discharged in bankruptcy. (Because college was affordable, remember? No one even NEEDED a "student loan," much less one subsidised by our tax dollars, thus bankruptcy abuse did not occur. But when Liberals made "student loans" available on the tax dollars, colleges jacked up tuition to match increased borrowing abilities, creating a Higher Education Bubble -- which WILL burst if we don't stop insane spending of tax$$ on making/backing college loans.) PROOF: "By 1977 only .3% of student loans had been discharged in bankruptcy." Source: "The History of Student Loans and Bankruptcy Discharge," by Steven Palmer, Partner at Curtis, Casteel & Palmer, PLLC, LinkdIn, Published Oct 1, 2015: LINK * Archive-1 * Archive-2. MOREOVER: "Debunking the first premise is the fact that by 1977, under 0.3% of the value of all federally guaranteed student loans had been discharged in bankruptcy...(See H.R. REP. NO. 95-595, at 148 (1977).)" Source: "ENDING STUDENT LOAN EXCEPTIONALISM: THE CASE FOR RISK-BASED PRICING AND DISCHARGEABILITY," 126 Harv. L. Rev. 587, HARDARD LAW REVIEW, quote from p.607, Dec. 20, 2012: PDF paper * Archives: 1 * 2 * Local cache * 3 * 4 * 5 * Article cite * Archives: 1 * 2 * Local cache * 3 * 4 * 5 * Thus, there was no abuse by students seeking bankruptcy, and thus removal was not justified. In fact, removal of bankruptcy defense (aka the Economic Second Amendment) made students defenseless, and thus *increased* price-gouging and abuses that were not present before. For example, credit card companies don't loan insane amounts because borrowers have bankruptcy defense. Thus, bankruptcy defense must be restored to avert and prevent a crash of the dollar, which is threatened with this insane lending using our tax dollars. Besides all the legal, moral, and Constitutional problems with removing bankruptcy defense from existing loan contracts, there are "practical" economic problems in unneeded administrative costs (not even counting how bankruptcy is a necessary Free Market check on excessive pork spending of our tax dollars, here, a "check" needed to save untold $Trillions). How so, you might ask? Let's ask an expert on the subject: Source: “Written Testimony of Attorney John Rao,” by Atty. John Rao, Esq., Attorney for: National Consumer Law Center, June 19, 2019: LINK ; Archive Today cache (clips part of PDF doc) ; Wayback Machine archive-A ; Wayback Machine archive-B ; Local cache ; Mirror-1 archive ; Mirror-2 archive ; Mirror-3 archive: Before the House Judiciary Subcommittee on Antitrust, Commercial, and Administrative Law Oversight of Bankruptcy Law and Legislative Proposals Source: “Hearings: Oversight of Bankruptcy Law and Legislative Proposals,” testimony before The Subcommittee on Antitrust, Commercial, and Administrative Law Oversight of Bankruptcy Law and Legislative Proposals, U.S. House Committee on the JUDICIARY, Hon. Jerrold "Jerry" Nadler, Chairman, Date: Tuesday, June 25, 2019 - 02:00pm ; Location: 2141 Rayburn House Office Building, Washington, DC 20515: LINK-A ; LINK-B ; Archive Today cache ; Wayback Machine archive ; Local cache ; Mirror-1 archive ; Mirror-2 archive ; Mirror-3 archive Thus, there is yet another reason that bankruptcy defense should be returned to this loan instrument: Savings of untold millions in administrative overhead costs to taxpayers for this "Epic Fail" lending system. ^ ^ ^ PROBLEMS ^ ^ ^ But we don't merely "gripe," "complain," or "argue" with one another; rather, we offer REAL solutions. v V v SOLUTIONS v V v The following bills, from prior sessions, need to be re-filed this session, passed, and signed into law:

· H.R.2648 - Student Borrower Bankruptcy Relief Act of

2019 [116th Congress (2019-2020)] – Sponsor: Rep. Nadler, Jerrold [D-NY-10] (Introduced 05/09/2019), Cosponsors – 29 total, 1 Republican,

28 Democrat

· S.1414 - Student Borrower Bankruptcy Relief Act of

2019 [116th Congress (2019-2020)] – Sponsor: Sen. Durbin, Richard J. [D-IL] (Introduced 05/09/2019), Cosponsors – 21 total, 1 Independent,

20 Democrat

HOUSE JUDICIARY HEARING ON H.R.5043 (111th) COMMITTEE Chairman, Rep. John Conyers, Jr. (D-MI-14), Ranking Member, Rep. Lamar Smith (R-TX-21), SUB-COMMITTEE Chairman, Rep. Steve Cohen. (D-TN-09), Ranking Member, Rep. Trent Franks (R-AZ-08), selected committee member discussed below, Rep. Jim Jordan (R-OH-04), who is current chairman of House Judiciary in the 118th Congress, 2023-2024